US Banks Struggle

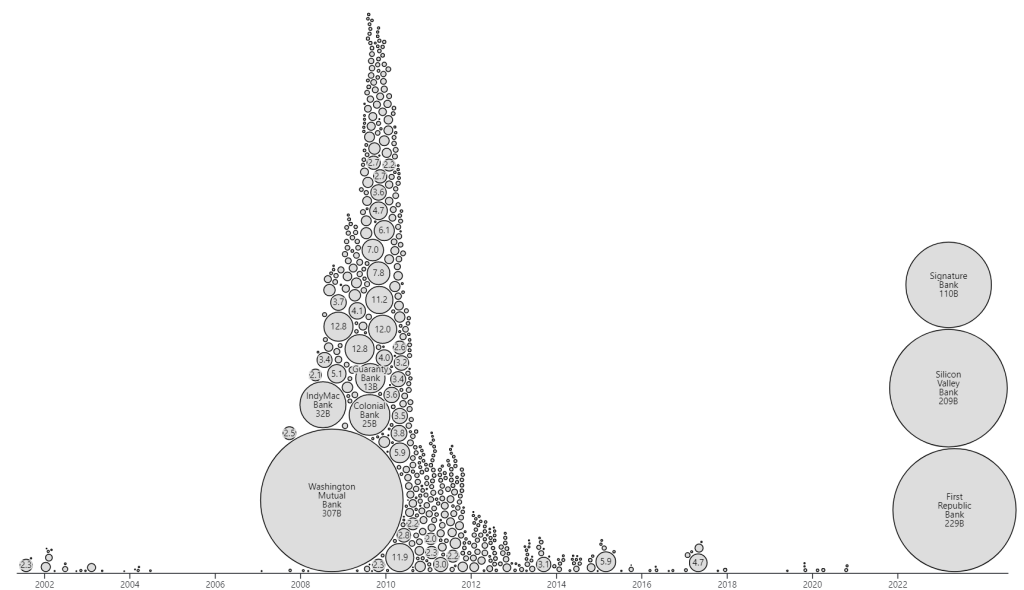

Silicon Valley Bank (SVB) analysis reveals a concerning trend in US banks’ financial health, as more than 500 banks have failed since 2000. The situation has worsened in 2023, with over 186 banks facing liquidity issues, and more than $500 billion lost in bank failures. Adding to these concerns, recent reports have identified a common factor among three US bank failures in the last two months: all three were audited by KPMG.

SVB’s study evaluated banks of all sizes, considering factors such as asset quality, liquidity, and capitalization. The analysis found that many smaller banks with lower capitalization levels and weaker asset quality are at risk of collapse, making them more vulnerable to economic downturns.

The report also highlights the geographical distribution of these struggling banks, with a concentration in states like California, Texas, and New York. This suggests that the risks associated with the US banking industry are widespread, affecting the nation’s financial landscape.

A recent article from Business Today underscores the growing concerns in the banking sector, pointing out that KPMG audited three banks that have failed within the last two months. The connection raises questions about KPMG’s role in these bank failures and the effectiveness of their audits in identifying potential risks.

In conclusion this reveals a troubling trend in the US banking industry, as liquidity issues continue to plague over 186 banks in 2023. The connection between KPMG and the recent bank failures adds another layer of complexity to the situation. Investors and consumers must remain cautious and vigilant, understanding the financial health of banks to make informed decisions about investments and banking.